Why Choose Buy-to-Let Mortgages for Overseas Landlord Portfolios?

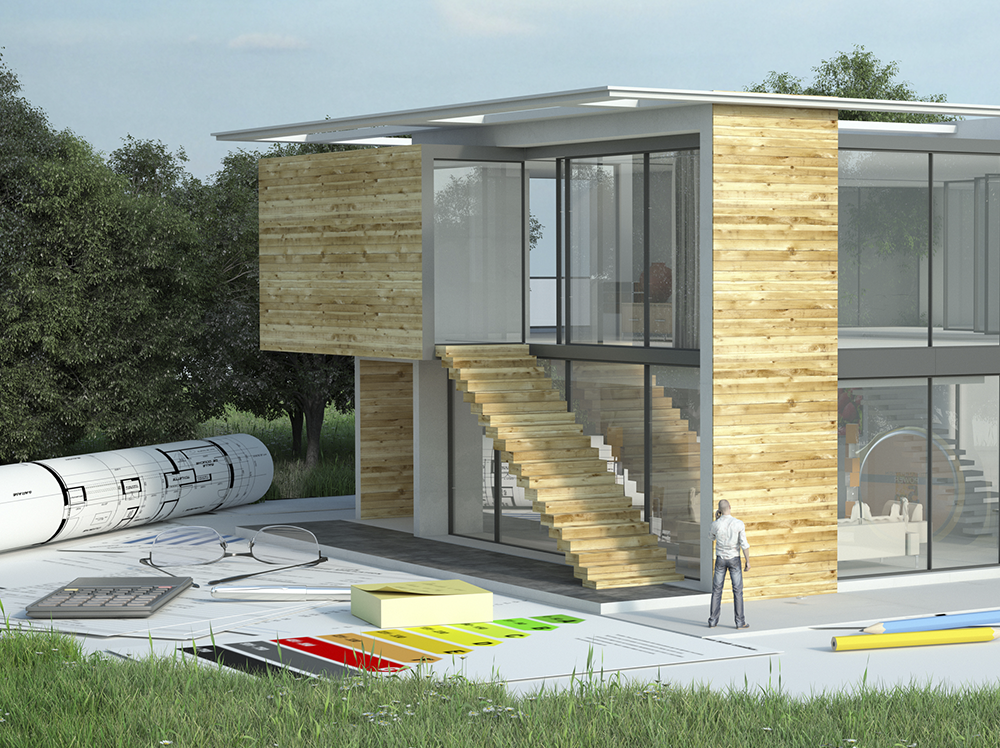

Are you dreaming of building your perfect home in the UK? Let Liquid Expat Mortgages turn that dream into reality with our specialised self-build mortgage solutions! Unlike traditional mortgages, our self-build financing empowers you to oversee every aspect of your home’s creation. From securing the plot to putting on the finishing touches, we’ve got you covered at every stage.

Simple Steps To Your Custom-Built Home

- Application & Approval: Start by applying for our self-build mortgage. Our experts will assess your financial situation and project viability, providing you with an agreement in principle swiftly.

- Plot Purchase: Haven’t secured a plot yet? No worries! You can utilise our mortgage funds to purchase the perfect piece of land for your dream home.

- Initial Stage Payment: Once you have your plot, we’ll release an initial payment to kickstart your project, covering essential costs like planning and permits.

- Stage Payments During Construction: As your home takes shape, we release funds at key milestones, ensuring your project stays on track. Just provide evidence of progress, and we’ll keep the funds flowing.

- Valuation Inspections: Our thorough inspections ensure that each stage is completed to satisfaction, giving you peace of mind throughout the construction process.

- Final Valuation & Mortgage Conversion: Once the self-build is complete, we conduct a final valuation. If all’s well, your self-build mortgage seamlessly converts into a standard mortgage, providing long-term financing for your new home.